BREAKTHROUGH FUND II

Fuelling Southwestern Ontario:

Local Empowerment, Impactful Investment

BECOME AN IMPACT INVESTOR

Align your investments with your values, and earn a financial return while supporting positive social, environmental, and community impact.

ABOUT THE FUND

The VERGE Breakthrough Fund II (VBFII) is a local impact investing fund that provides loans to impactful ventures in Southwestern Ontario.

We are faced with enormous social and environmental problems at a global and local level, from inequality and poverty to public health and climate crises. Changemakers in our region are developing and scaling innovative solutions to our most complex community issues; reducing poverty, building affordable housing, improving access to basic needs & more.

One of the biggest hurdles to implementing these solutions is lack of capital. VERGE Breakthrough Fund II aims to connect social driven investors with the ventures that are addressing these pressing issues our community faces.

The Fund

We support social purpose real estate projects, climate action projects and social enterprise projects by providing affordable financing solutions.

We prioritize social entrepreneurs from (or organizations that serve) underrepresented communities. This includes Indigenous, rural, racialized, newcomers, 2SLGBTQI+, people with disabilities, women and those who identify as non-binary

Fund Raising Timeline

The Fund is expected to close to new investors on June 30, 2026.

Fund Management

A non-profit corporation, VergeSVX II Inc., acts as Trustee over the Fund. VergeSVX II Inc. is governed by an independent board of directors. SVX, a leading Canadian impact investing firm, provides ongoing administration for the Fund.

IMPACT REPORTING

Ventures will provide an impact plan that includes an impact baseline and improvement plan

The plan would be continuously tracked throughout the life of the investment to ensure targets are met

Standards cross-portfolio metrics to report quarterly and annual aggregate impact

FUND STRUCTURE

Investment Type: Units of a Trust

Target Fund Size: $5 Million

Investment Term: 7 Years

Investments: Debt financing

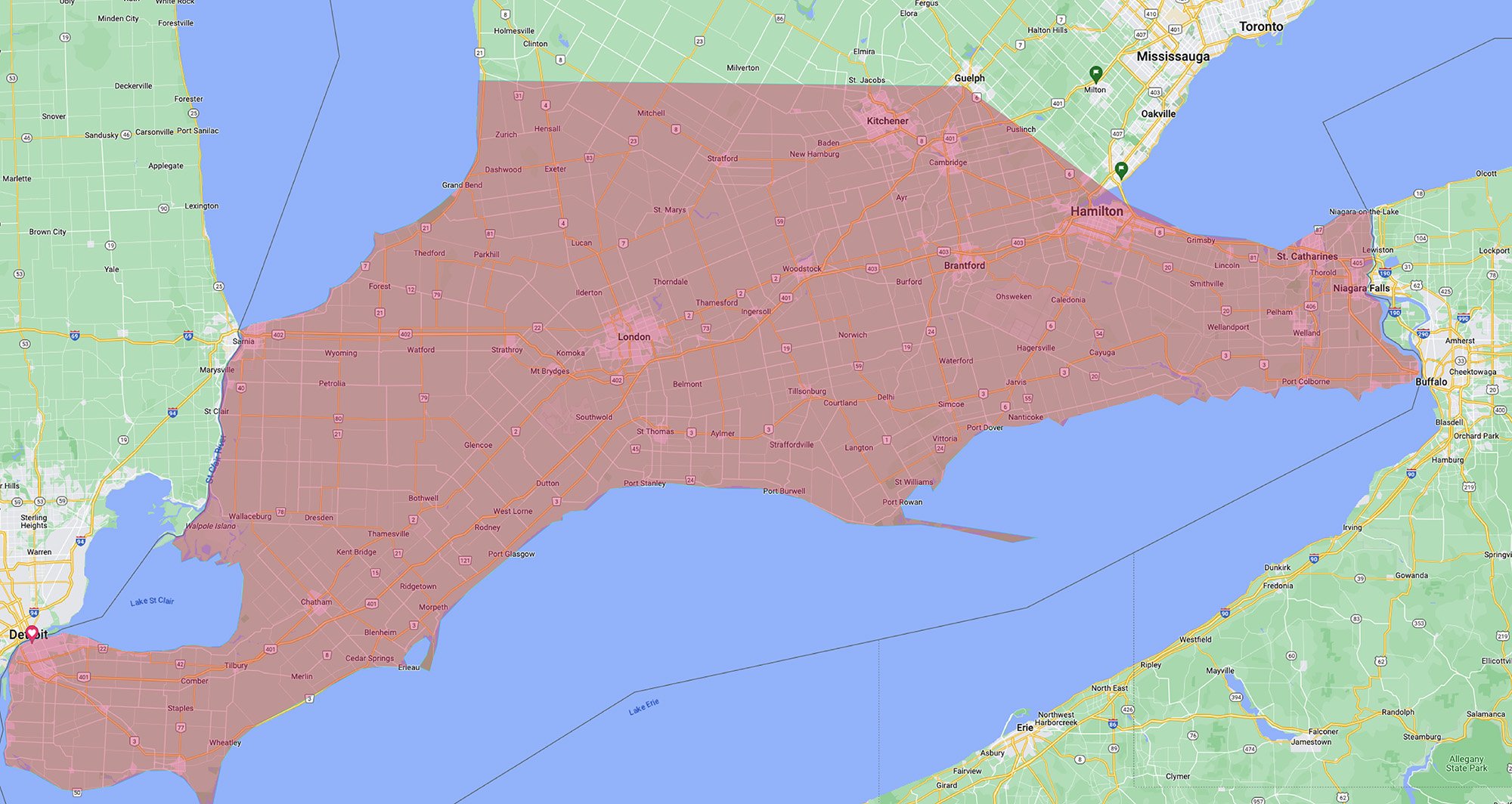

SERVING SOUTHWESTERN ONTARIO

VERGE Capital supports local economies and communities across Southwestern Ontario.

OUR INVESTMENT PRIORITIES

VERGE Capital’s investment priorities are aligned with the United Nations Sustainable Development Goals (SDGs), which are “a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere.” The fund’s areas of focus are:

EQUITY & JUSTICE

We invest in social enterprises that increase access to food, housing, employment, education, healthcare, cultural supports, and economic opportunities for historically excluded and marginalized populations. We support those who are building a more inclusive economy that promotes prosperity and belonging for all, and where no one is left behind.

CLIMATE ACTION

We invest in social enterprises that reduce greenhouse gas emissions, divert waste from landfill, restore our natural environment, and are leading the transition to a circular and carbon-neutral economy. We support those who understand our climate crisis requires urgent action to protect our (only) planet for current and future generations.

SYSTEMIC CHANGE

We invest in social enterprises that address the root causes of our systemic social, economic, racial and gender inequalities. We support those who are working towards collaborative, long-term solutions that shift culture, behaviour, and policy to create lasting change.

LOCAL IMPACT

We invest in social enterprises that understand and are committed to serving the needs of their local community. We support those who are hiring and buying local, involving local communities in volunteering, leadership, or ownership opportunities, and building a brighter future for Southwestern Ontario.

INVEST

With the VERGE Breakthrough Fund II, investors can harness the power of their investment portfolio to foster positive community change.

We invite you to align your financial goals with your social values for a more rewarding and purpose-driven investment journey.

Interested In Investing? Contact Us

VERGE BREAKTHROUGH FUND II is an initiative led by:

For investors interested in searching other impact investments, we invite you to check out SVX Impact Index – Canada's largest directory of impact investments. Set up your free account to learn more.