BREAKTHROUGH FUND II

Fuelling Southwestern Ontario:

Local Empowerment, Impactful Investment

ABOUT THE FUND

The VERGE Breakthrough Fund II (VBFII) is a local impact investing fund that provides loans to Southwestern Ontario social enterprises and offers impact investment opportunity to investors.

We are faced with enormous social and environmental problems at a global and local level, from inequality and poverty to public health and climate crises. There is a growing community of Changemakers in our region that are developing and scaling innovative solutions to our most complex community issues; reducing poverty, building affordable housing, improving access to basic needs & more. One of the biggest hurdles to implementing these solutions is lack of capital. Access to capital is a major concern and challenge for these social enterprises.

VERGE Breakthrough Fund aims to address this need by connecting social driven investors, with the opportunity to finance high quality social enterprises in Southwestern Ontario. This financing will help the social enterprises successfully turn unmet social, economic and environmental needs into viable business opportunities. Thereby creating jobs, protecting the environment, reducing poverty and driving growth in the region.

The VERGE Breakthrough Fund II makes it possible for investors to leverage their investment portfolio to create positive community impact through a pooled approach. The VERGE Breakthrough Fund II demonstrates that investors can earn a financial return while creating significant community impact.

Who is the fund available to?

The fund is available to accredited investors, institutional investors and retail investors.

The Fund

We successfully raised $2.26m in 2019 for Fund I. This capital was deployed to support 24 social impact enterprises in Southwestern Ontario. After the successful deployment of the first Breakthrough Fund, VERGE is now raising capital for its second Breakthrough Fund.

The VERGE Breakthrough Fund II is a $5m local impact investing fund focused on providing loans to social enterprises in Southwestern Ontario that contribute to the United Nations Sustainable Development Goals. We prioritize social entrepreneurs from (or organizations that serve) underrepresented communities. This includes Indigenous, rural, racialized, newcomers, 2SLGBTQI+, people with disabilities, women and those who identify as non-binary.

We support social purpose real estate projects, climate action projects and social enterprise projects by providing affordable financing solutions to both early-stage and established social enterprises.

Fund Raising Timeline

• First Close August 2023

• Final Close January 2025

Fund Management

Pillar Nonprofit Network has partnered with SVX to deliver VERGE Breakthrough Fund II.

FUND STRUCTURE

*5M Fund Size

7 Tenure

Debt Financing

*with Capacity to raise up to $10M

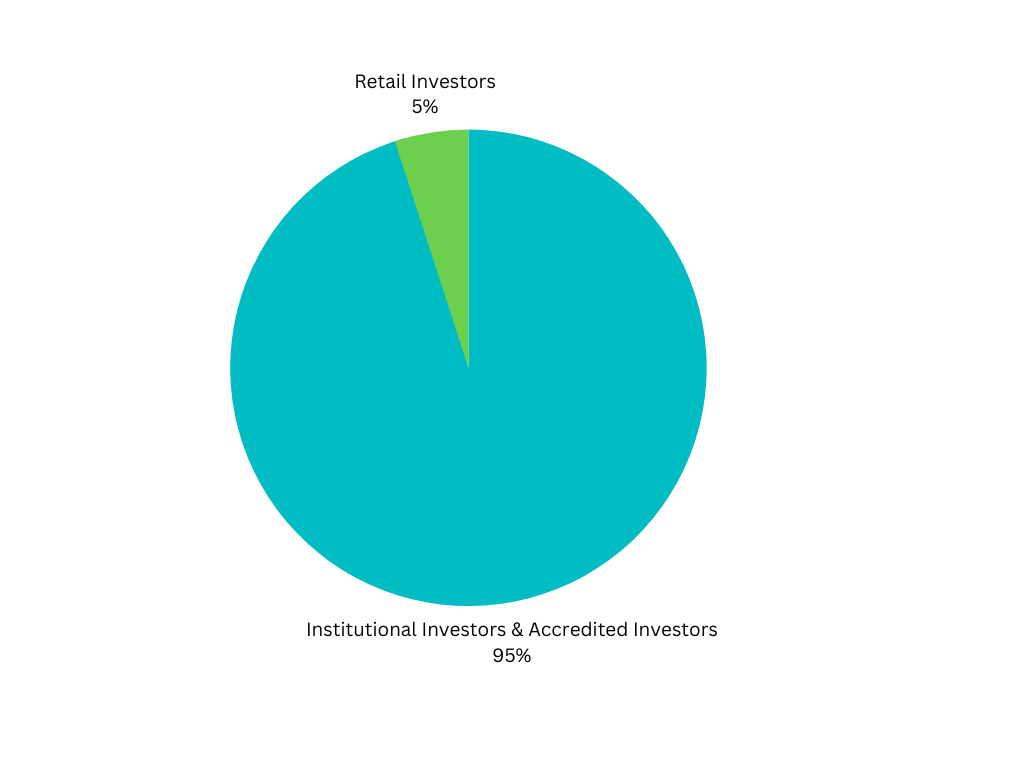

INVESTOR GROUPS

Investor groups refers to a group of people who pool their money to make investments. As exmeplified in the pie chart, 95% of investor groups within VERGE Breakthrough Fund II will consist of institutional investors and accredited investors, while the remaining 5% will make up retail investors. For definitions on retail investors, institutional investors, and accredited investors, please refer to the terminology section at the bottom of the page.

PORTFOLIO MIX

Portfolio mix refers to the types of companies and investments that make up a pool of funding.

Examples of climate action organizations:

Examples of civic assets:

Real estate, community buildings, water treatment facilities, universities, libraries, schools, parks, heritage buildings, parkings, airports, public transit.

Examples of social enterprises:

INVESTMENT APPROACH

INVESTMENT STRUCTURE

Typically, loans are fixed-rate loans

Open to variable rate of revenue share loans

Flexibility in payment terms varies by borrower

IMPACT STANDARD

Social enterprises must have demonstrated impact and provide regular reporting to VERGE Capital

IMPACT REPORTING

Ventures will provide an impact plan that includes an impact baseline and improvement plan

The plan would be continuously tracked throughout the life of the investment to ensure targets are met

Standards cross-portfolio metrics to report quarterly and annual aggregate impact

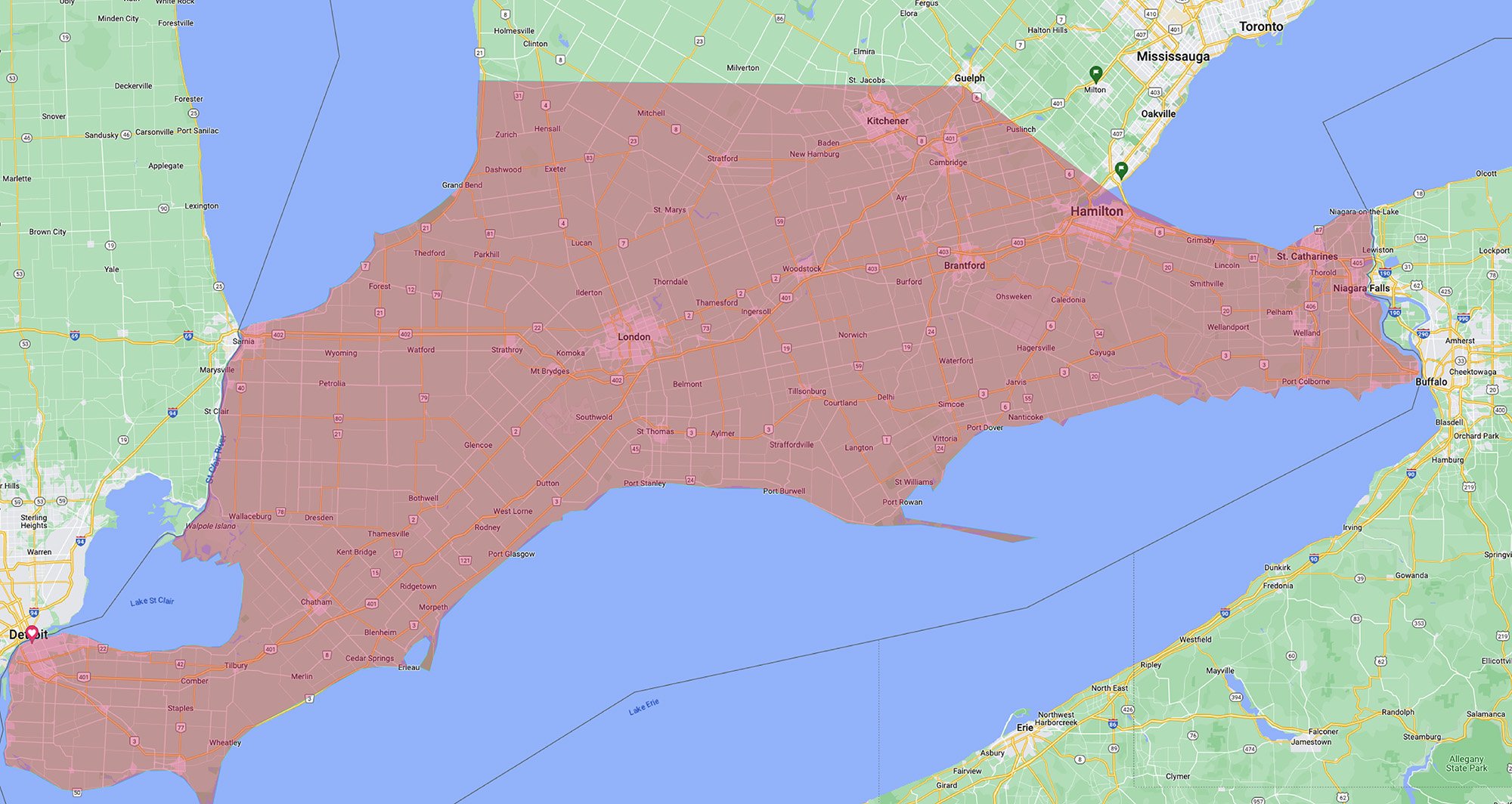

SERVING SOUTHWESTERN ONTARIO

VERGE Capital supports local economies and communities across Southwestern Ontario by investing in social enterprises who are committed to doing the same. Though there is no universal definition, we consider Southwestern Ontario as the general area between Windsor and Hamilton-Niagara. We regret that this does not include Halton Region (Burlington, Halton Hills, Milton, Oakville) or the rest of the Greater Toronto Area.

OUR INVESTMENT PRIORITIES

VERGE Capital’s investment priorities are aligned with the United Nations Sustainable Development Goals (SDGs), which are “a universal call to action to end poverty, protect the planet and improve the lives and prospects of everyone, everywhere.” We have simplified the 17 SDGs into four areas of focus:

EQUITY & JUSTICE

We invest in social enterprises that increase access to food, housing, employment, education, healthcare, cultural supports, and economic opportunities for historically excluded and marginalized populations. We support those who are building a more inclusive economy that promotes prosperity and belonging for all, and where no one is left behind.

CLIMATE ACTION

We invest in social enterprises that reduce greenhouse gas emissions, divert waste from landfill, restore our natural environment, and are leading the transition to a circular and carbon-neutral economy. We support those who understand our climate crisis requires urgent action to protect our (only) planet for current and future generations.

SYSTEMIC CHANGE

We invest in social enterprises that address the root causes of our systemic social, economic, racial and gender inequalities. We support those who are working towards collaborative, long-term solutions that shift culture, behaviour, and policy to create lasting change.

LOCAL IMPACT

We invest in social enterprises that understand and are committed to serving the needs of their local community. We support those who are hiring and buying local, involving local communities in volunteering, leadership, or ownership opportunities, and building a brighter future for Southwestern Ontario.

INQUIRE

FOR APPLICANTS

VERGE Breakthrough Fund II is designed to connect social enterprises with social driven investors. By securing this funding, social enterprises can convert previously unmet social, economic, and environmental needs into viable business ventures.

ELIGIBILITY CRITERIA

Social enterprise operating in Southwestern Ontario and aligns with our investment mandate

Minimum 1-2 years operational history

Currently generating revenue, has existing customers or assets secured

Full-time experienced management

No limitations around industry sector, stage of growth, or organization structure (for-profit business or non-profit organization)

FOR INVESTORS

We are looking to raise capital from investors hoping to leverage their investment portfolio to earn a financial return while creating significant community impact. This opportunity is open to accredited investors and up to 5% of the fund will be available to retail investors.

With the VERGE Breakthrough Fund II, investors can harness the power of their investment portfolio to foster positive community change. The fund showcases how investors have the opportunity to not only achieve financial returns but also generate substantial community impact. By participating in the VERGE Breakthrough Fund II, investors can align their financial goals with their social values, paving the way for a more rewarding and purpose-driven investment journey.

Interested In Investing? Contact Us

TERMINOLOGY

ACCREDITED INVESTOR

An investor who meets certain criteria regarding income, net worth, and qualifications.

INSTITUTIONAL INVESTOR

A company or organization that invests money on behalf of other people. Examples include mutual funds, pensions, and insurance companies.

RETAIL INVESTOR

A nonprofessional investor who buys and sells securities, mutual funds, or ETFs through a brokerage firm or savings account.

SOCIAL ENTERPRISE

There is no universal definition for a ‘social enterprise’, but we like this one from our friends at the Women of Ontario Social Enterprise Network:

“Social Enterprise is an apporach to business (rather than a legal structure) that is value-based and principles-focused. Its value proposition is incorperated into its mandate and directs its operation. Specifically, they seek to have a positive social, cultural, or environmental impact through its operations, and/or sale of products or services. [We have] adopted a broad definition of social enterprise that includes cooperatives, nonprofit and for-profit business forms.”

Ortiz, J & Meades, S. (2021). The Story of WOSEN: Women of Ontario Social Enterprise Network Interim Report. Sault Ste. Marie, ON, NORDIK Institute, p.4.

One important distinction to note: this is different than a corporate social responsibility (CSR), philanthropic, or “giving back” approach, where money, products/services, or employee time is donated toward charitable causes or organizations.

See ‘Investment Priorities’ section to learn more about what we mean by ‘positive social, cultural, or environmental impact’.